Ramadan Dua List PDF: A Comprehensive Guide

Discover a wealth of spiritual enrichment with readily available Ramadan Dua lists in PDF format‚ offering daily guidance and supplications throughout the blessed month.

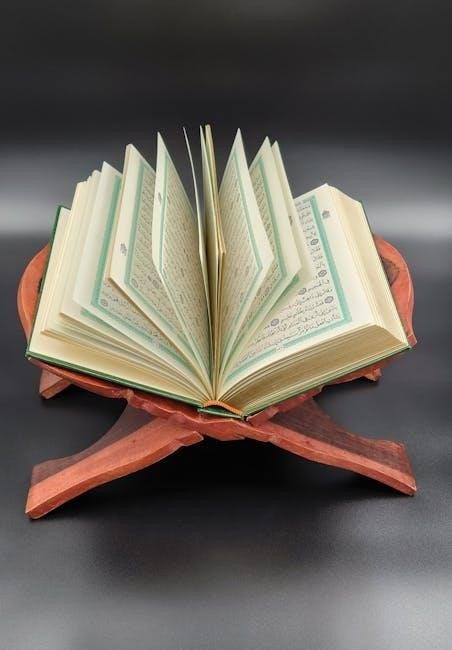

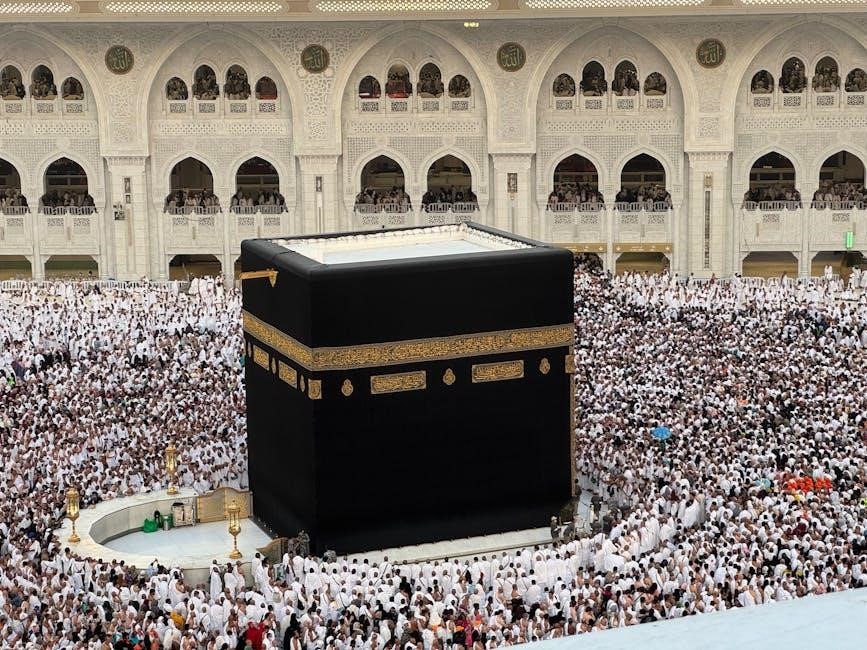

Ramadan‚ the ninth month of the Islamic calendar‚ is a profoundly sacred period for Muslims worldwide‚ marked by fasting‚ reflection‚ and increased devotion to Allah. Central to this heightened spirituality is the practice of Dua – heartfelt supplication and invocation. A Ramadan Dua List PDF serves as an invaluable resource‚ compiling essential prayers and supplications specifically recommended for this holy month.

These Duas aren’t merely recited words; they represent a direct connection with the Divine‚ a means of seeking forgiveness‚ guidance‚ and blessings. Utilizing a dedicated PDF list ensures no significant supplication is overlooked during this opportune time. Many lists categorize Duas for various occasions within Ramadan‚ such as before Suhoor (pre-dawn meal)‚ during Iftar (fast-breaking)‚ and especially for Laylatul Qadr (the Night of Power).

The accessibility of Ramadan Dua List PDFs allows Muslims of all backgrounds to easily incorporate these powerful prayers into their daily routines‚ enhancing their spiritual experience and drawing closer to Allah’s mercy.

The Importance of Dua During Ramadan

Dua holds immense significance throughout the year in Islam‚ but its importance is amplified exponentially during Ramadan. This month is considered a time when Duas are more readily accepted by Allah‚ offering a unique opportunity for spiritual growth and seeking forgiveness. A Ramadan Dua List PDF streamlines this process‚ providing a curated collection of powerful supplications.

Fasting during Ramadan isn’t solely about abstaining from food and drink; it’s about cultivating self-discipline‚ empathy‚ and a heightened awareness of one’s dependence on Allah. Dua complements this practice by fostering humility and a constant connection with the Divine. Utilizing a PDF list ensures consistent engagement with these vital prayers.

The availability of these lists encourages Muslims to actively seek blessings‚ protection‚ and guidance‚ maximizing the spiritual benefits of Ramadan. Consistent recitation of Duas from a Ramadan Dua List PDF strengthens faith and deepens the relationship with Allah.

Understanding the Spiritual Significance

Ramadan is a period of profound spiritual reflection and renewal for Muslims worldwide‚ and Dua serves as the very heart of this transformation. A Ramadan Dua List PDF isn’t merely a collection of words; it’s a pathway to deepening one’s connection with Allah and seeking His boundless mercy. The spiritual significance lies in acknowledging our reliance on the Divine in all aspects of life.

Each Dua within these lists carries a specific intention‚ addressing various needs – forgiveness‚ guidance‚ strength‚ and gratitude. Utilizing a PDF format allows for easy access and consistent recitation‚ embedding these powerful supplications into daily routines. This intentional practice cultivates mindfulness and a heightened spiritual awareness.

The act of making Dua itself is a form of worship‚ demonstrating humility and submission to Allah. A well-structured Ramadan Dua List PDF facilitates this worship‚ offering a comprehensive guide to navigate the spiritual landscape of the holy month and unlock its transformative potential.

Essential Duas for the Month of Ramadan

Explore key supplications like Dua Iftitah‚ Dua Tawassul‚ and others‚ often compiled within a convenient Ramadan Dua List PDF for easy access.

Dua Iftitah (Opening Dua)

Dua Iftitah‚ the opening supplication‚ holds immense significance in Islamic tradition‚ particularly during Ramadan. Often found within a comprehensive Ramadan Dua List PDF‚ this dua is recited at the beginning of salat (prayer)‚ seeking guidance and forgiveness from Allah. It’s a beautiful expression of humility and dependence on the Divine.

The Dua Iftitah isn’t a fixed‚ rigidly prescribed text; variations exist‚ but they all share a common theme of acknowledging Allah’s majesty and seeking His blessings. Many PDF resources dedicated to Ramadan duas provide transliterations and translations‚ making it accessible to Muslims worldwide‚ regardless of their native language. Reciting this dua with sincerity and understanding enhances the quality of prayer and strengthens one’s connection with Allah during this sacred month. It prepares the heart and mind for focused worship and reflection.

Finding a reliable Ramadan Dua List PDF ensures you have access to authentic and properly formatted versions of this essential supplication.

Dua Tawassul (Intercession Dua)

Dua Tawassul‚ the dua of intercession‚ is a powerful supplication frequently included in Ramadan Dua List PDFs. It centers around seeking blessings and forgiveness through the righteous – the Prophets‚ pious individuals‚ and even one’s parents. This practice isn’t about worshipping anyone besides Allah‚ but rather acknowledging the honor and closeness these individuals have with Him.

Within a PDF compilation of Ramadan duas‚ you’ll find variations of Dua Tawassul‚ often incorporating specific names and attributes of revered figures. The core principle involves asking Allah to grant acceptance of your dua due to His favor upon these blessed souls. It’s a demonstration of love‚ respect‚ and recognition of their elevated status.

Many scholars encourage reciting Dua Tawassul‚ especially during Ramadan‚ as it’s a time when doors of mercy are open wide. A well-structured Ramadan Dua List PDF will provide the Arabic text‚ transliteration‚ and translation‚ facilitating correct pronunciation and comprehension.

Ya Aliyu Ya Adheem (O High‚ O Great)

“Ya Aliyu Ya Adheem” – meaning “O High‚ O Great” – is a profoundly impactful invocation often found within comprehensive Ramadan Dua List PDFs. This dua directly addresses Allah by His majestic attributes‚ acknowledging His supreme power and elevated position above all creation. It’s a declaration of humility and reverence before the Divine.

Ramadan Dua List PDFs typically present this dua alongside its Arabic text‚ transliteration for ease of pronunciation‚ and a clear English translation. Reciting “Ya Aliyu Ya Adheem” is believed to invoke Allah’s boundless mercy and facilitate the acceptance of subsequent supplications. It’s a powerful opening to personal prayers.

The inclusion of this specific invocation in Ramadan compilations highlights its significance during this sacred month. Many Muslims incorporate it into their daily routines‚ seeking closeness to Allah and beseeching Him for forgiveness‚ guidance‚ and blessings. A well-organized PDF will often explain the context and benefits of this powerful dua.

Allahuma Adkhil Ala (O Allah‚ Enter Upon)

“Allahuma Adkhil Ala” – translating to “O Allah‚ Enter Upon [us]” – is a significant supplication frequently featured within detailed Ramadan Dua List PDFs. This dua is a heartfelt request for Allah’s presence and blessings to descend upon the supplicant and the Muslim community during this holy month.

Ramadan Dua List PDFs often present this invocation with its original Arabic script‚ a phonetic transliteration to aid pronunciation‚ and a clear English interpretation. Reciting “Allahuma Adkhil Ala” is believed to open doors to divine mercy‚ acceptance of prayers‚ and spiritual elevation. It’s a plea for Allah’s nearness.

Its inclusion in Ramadan collections underscores its importance in seeking Allah’s favor. Muslims often recite this dua during moments of reflection‚ after obligatory prayers‚ or while engaging in acts of worship. A comprehensive PDF resource will likely provide context and explain the profound meaning behind this powerful invocation‚ encouraging consistent recitation.

Allahuma Rabba (O Allah‚ Lord)

“Allahuma Rabba” – meaning “O Allah‚ Lord” – is a foundational invocation consistently found within comprehensive Ramadan Dua List PDFs. This dua acknowledges Allah’s absolute sovereignty and serves as a humble appeal for guidance and acceptance during the sacred month of Ramadan.

Ramadan Dua List PDFs typically present this supplication alongside its Arabic text‚ a transliteration for accurate pronunciation‚ and a clear English translation. Reciting “Allahuma Rabba” is believed to strengthen one’s connection with the Divine‚ fostering a sense of reliance and devotion. It’s a recognition of Allah’s power and grace.

Its prominent placement in Ramadan collections highlights its significance in seeking Allah’s blessings. Muslims often recite this dua during times of need‚ after performing acts of worship‚ or as a general expression of gratitude. A well-structured PDF resource will often elaborate on the spiritual benefits and proper etiquette associated with this essential invocation.

Daily Duas for Ramadan ー A 30-Day Plan

Ramadan Dua List PDFs often feature structured 30-day plans‚ providing specific supplications for each day‚ enhancing spiritual focus and consistent devotion.

Week 1: Duas for the First 7 Days

Ramadan Dua List PDFs commonly dedicate the initial week to foundational supplications‚ emphasizing repentance and seeking Allah’s blessings as the fast begins. These often include seeking strength to fulfill the obligations of Ramadan‚ such as consistent prayer‚ fasting from dawn till dusk‚ and engaging in charitable acts.

Many PDFs will outline specific Duas for each day‚ focusing on themes like gratitude for the opportunity to witness Ramadan‚ asking for guidance in avoiding sins‚ and requesting forgiveness for past transgressions. A. Rahman Khan’s compilation‚ frequently available as a PDF‚ provides detailed Duas for each of the thirty days‚ starting with supplications for the first week.

These early Duas aim to set a positive spiritual tone for the entire month‚ encouraging believers to approach Ramadan with sincerity and a renewed commitment to worship. Utilizing a PDF ensures easy access and consistent recitation of these vital supplications.

Week 2: Duas for Days 8-14

Ramadan Dua List PDFs for the second week typically shift focus towards increasing devotion and seeking closeness to Allah. These Duas often emphasize the importance of patience‚ perseverance‚ and utilizing the blessings of this sacred month to the fullest extent. The supplications frequently request assistance in controlling desires and avoiding actions that may invalidate the fast.

A. Rahman Khan’s PDF compilation continues with specific Duas for each day‚ building upon the foundation established in the first week. These Duas may include seeking protection from negative thoughts and harmful influences‚ and asking for the ability to reflect on one’s actions and improve spiritual conduct.

Many PDF resources highlight the significance of seeking forgiveness and strengthening one’s faith during this period. Consistent recitation of these Duas aims to cultivate a deeper connection with the Divine and maximize the spiritual benefits of Ramadan.

Week 3: Duas for Days 15-21

Ramadan Dua List PDFs for the third week often concentrate on seeking forgiveness and preparing for the approaching Laylatul Qadr – the Night of Power. The Duas emphasize sincere repentance for past sins and a renewed commitment to righteous conduct. These supplications frequently request Allah’s mercy and guidance‚ acknowledging human weakness and dependence on divine assistance.

A. Rahman Khan’s PDF continues providing daily Duas‚ now with a heightened emphasis on spiritual purification. These Duas may include specific requests for acceptance of fasts‚ prayers‚ and other acts of worship performed during Ramadan. They also encourage reflection on the blessings received and gratitude towards Allah.

Many PDF resources highlight the importance of increased charity and kindness towards others during this period. Consistent recitation of these Duas aims to foster empathy‚ compassion‚ and a stronger sense of community‚ maximizing the spiritual rewards of Ramadan.

Week 4: Duas for Days 22-30

Ramadan Dua List PDFs for the final week intensify the focus on seeking Laylatul Qadr and maximizing blessings before the month concludes. These Duas often incorporate heartfelt pleas for acceptance of all previous worship and a continuation of righteous habits beyond Ramadan. They emphasize gratitude for the opportunity to have fasted and prayed during this sacred time.

A. Rahman Khan’s PDF continues its daily provision of Duas‚ now with a strong emphasis on safeguarding against reverting to past shortcomings. These supplications frequently request Allah’s steadfastness in faith and the strength to overcome temptations.

Resources highlight the importance of sincere reflection and making firm intentions for continued spiritual growth. Consistent recitation of these Duas aims to solidify the positive changes cultivated throughout Ramadan‚ ensuring its benefits extend far beyond the month’s end. Many PDFs also include Duas for a blessed farewell to Ramadan.

Specific Duas for Key Ramadan Moments

Ramadan Dua List PDFs frequently feature specialized supplications for pivotal moments like Laylatul Qadr‚ Suhoor‚ and Iftar‚ enhancing spiritual connection.

Dua for Laylatul Qadr (Night of Power)

Laylatul Qadr‚ the Night of Power‚ is arguably the most sacred night within the month of Ramadan‚ believed to be when the first verses of the Quran were revealed. Ramadan Dua List PDFs invariably dedicate a significant section to supplications specifically for this night‚ recognizing its immense spiritual importance.

These duas often express a heartfelt plea for forgiveness‚ seeking protection from the fires of Hell‚ and requesting acceptance of righteous deeds. Many PDF resources provide multiple options‚ ranging from lengthy‚ detailed supplications to shorter‚ more concise prayers. A common theme is the earnest desire for Allah’s blessings and guidance.

Reciting these duas with sincerity and devotion is considered highly rewarding. Some PDF guides also include the recommended practices for this night‚ such as engaging in prolonged prayer (Qiyam al-Layl) and reflecting upon the Quran. The goal is to maximize spiritual benefit during this uniquely blessed time‚ hoping for divine favor and acceptance.

Dua Before Suhoor (Pre-Dawn Meal)

Suhoor‚ the pre-dawn meal‚ is a blessed time in Ramadan‚ and reciting a dua before partaking in it is a highly recommended practice. Ramadan Dua List PDFs consistently feature specific supplications designed for this moment‚ acknowledging its significance in preparing for a day of fasting.

These duas typically invoke Allah’s blessings upon the food‚ requesting strength and ability to observe the fast with sincerity and devotion. They often include a plea for acceptance of the fast and for guidance in performing righteous deeds throughout the day. Many PDF resources offer variations‚ catering to different preferences.

The act of reciting a dua before Suhoor is seen as a way to express gratitude to Allah for His provision and to seek His assistance in fulfilling the obligations of Ramadan. PDF guides emphasize the importance of intention and sincerity while making these supplications‚ aiming for a spiritually fulfilling start to the fasting day.

Dua During Iftar (Breaking the Fast)

Iftar‚ the breaking of the fast‚ is a moment of immense spiritual reward in Ramadan‚ and reciting a dua at this time is considered highly virtuous. Ramadan Dua List PDFs invariably include specific supplications tailored for Iftar‚ reflecting gratitude to Allah for enabling Muslims to complete their fast.

These duas commonly express thanks for the provision of food and water‚ and seek forgiveness for any shortcomings during the day. They often incorporate a request for acceptance of the fast and for the opportunity to continue performing good deeds. Numerous PDF resources present diverse options‚ allowing individuals to choose a dua that resonates with them.

Reciting a dua during Iftar is a powerful way to acknowledge Allah’s blessings and to reaffirm one’s commitment to worship. PDF guides highlight the importance of sincerity and humility when making these supplications‚ aiming for a spiritually enriching conclusion to the fasting day.

Dua for Forgiveness (Istighfar)

Istighfar‚ seeking forgiveness from Allah‚ is a cornerstone of Islamic practice‚ and its importance is amplified during Ramadan. Ramadan Dua List PDFs dedicate significant space to duas specifically designed for repentance and seeking pardon. These supplications acknowledge human fallibility and express a sincere desire to return to a state of purity.

The duas often include phrases expressing remorse for past sins‚ a commitment to avoid repeating them‚ and a plea for Allah’s mercy and acceptance of repentance. Many PDF resources offer a variety of Istighfar options‚ ranging from concise phrases to more elaborate supplications.

Regularly reciting these duas throughout Ramadan is believed to cleanse the heart and draw one closer to Allah. PDF guides emphasize the sincerity and humility required for effective repentance‚ encouraging Muslims to reflect on their actions and strive for self-improvement.

Finding and Utilizing Ramadan Dua Lists in PDF Format

Explore numerous online Islamic resources to download comprehensive Ramadan Dua List PDFs‚ enabling convenient access to daily supplications throughout the holy month.

Where to Download Ramadan Dua PDFs

Numerous online platforms offer free Ramadan Dua List PDFs for download. Websites dedicated to Islamic teachings‚ such as Duas.org and IslamicFinder.org‚ frequently provide comprehensive collections categorized for easy access. Additionally‚ many Islamic centers and mosques distribute these PDFs through their websites or directly to their congregations.

Digital libraries like Archive.org also host a variety of digitized Islamic texts‚ including Ramadan Dua compilations. Social media platforms‚ particularly those with active Muslim communities‚ often share links to downloadable PDFs during the month of Ramadan.

Furthermore‚ mobile applications dedicated to Islamic prayer and supplications often include a PDF section containing Ramadan Duas. A quick search on Google or your preferred search engine using keywords like “Ramadan Dua PDF download” will yield a plethora of results‚ ensuring you find a suitable resource to enhance your spiritual practice this Ramadan.

Benefits of Using a PDF Dua List

Utilizing a Ramadan Dua List PDF offers several advantages for focused spiritual practice. The portability of a PDF allows for convenient access on various devices – smartphones‚ tablets‚ or computers – enabling recitation anytime‚ anywhere. A compiled list ensures you don’t miss essential supplications‚ covering various moments throughout the day and month.

PDF formats often include transliteration alongside the Arabic text‚ aiding those unfamiliar with the Arabic script in correct pronunciation. Having a structured list promotes consistency in your Dua routine‚ fostering a deeper connection with Allah.

Moreover‚ PDFs can be easily printed for offline use‚ eliminating reliance on internet connectivity. They serve as a valuable resource for families‚ allowing collective recitation and learning. A well-organized PDF can also include explanations of the Duas‚ enhancing understanding and sincerity in your supplications during this blessed month of Ramadan.

Tips for Effective Dua Recitation

Maximizing the benefits of your Ramadan Dua recitation requires mindful practice. Begin by understanding the meaning of the Duas – a PDF list with translations is incredibly helpful for this. Pronunciation is key; utilize transliteration within your PDF to ensure accuracy‚ and listen to recordings if needed.

Recite with sincerity (ikhlas) and humility (tadarru’)‚ focusing your heart and mind on the meaning of your supplications. Choose a quiet and respectful environment‚ free from distractions. Consistency is vital; aim to recite the Duas from your PDF list daily‚ even if briefly.

Supplement your recitation with reflection and contemplation. Don’t simply rush through the words; truly feel the connection with Allah. Combine Dua with acts of worship and charity to amplify its effect. Finally‚ remember that Allah is always listening‚ and have unwavering hope in His response‚ utilizing your Ramadan Dua List PDF as a guide.

Resources and Further Learning

To deepen your understanding and practice of Ramadan Duas‚ numerous online resources are available. Websites like IslamicFinder‚ DuaMaker‚ and various Islamic scholarly platforms offer comprehensive Ramadan Dua lists‚ often available for direct download as PDF files.

Explore digital libraries such as Archive.org for older‚ classical texts on Islamic supplications. YouTube channels dedicated to Islamic teachings frequently feature recitations and explanations of Ramadan Duas. Consider enrolling in online courses or webinars focused on the spiritual significance of Ramadan and the power of Dua.

Utilize mobile apps designed for Islamic prayer and Dua‚ many of which include dedicated Ramadan sections and downloadable PDF resources. Remember to verify the authenticity of any PDF or online resource with a trusted Islamic scholar to ensure accuracy and adherence to Sunnah practices‚ enhancing your spiritual journey.